Key Points

- Nuvalaw lands a $3M investment to revolutionize the online negotiation and arbitration of P&C insurance claims through legal tech.

- Partnering with Trust Arbitration, Nuvalaw boasts significant clientele and multiple awards, signaling its successful impact on the legal claims industry.

- The investment will further Nuvalaw’s technological advancements, including AI integration, and support its anticipated expansion into the lucrative US market.

- Nuvalaw’s platform promises remarkable efficiency gains, reducing lengthy claims processes and operational costs by digitizing and streamlining case handling.

Telemedicine Attorney Near Me: Your Ultimate Legal Guide

Mike Ruggles Founder & CEO Instagram Linkedin Follow me on Instagram & LinkedIn for exclusive

Metaverse Data Privacy Exposed: The Essential Legal Guide for Lawyers to Conquer the Virtual World’s Hidden Risks

Discover metaverse privacy secrets, navigate regulations, conquer emerging challenges, and master strategies to protect user

Shocking AI Revolution: Lawyers Beware!

Key Points: AI transforms the legal industry, offering cost-effective and efficient solutions. DoNotPay case study

Nuvalaw’s Multi-Million March: Reshaping Insurance Claims with Legal Tech

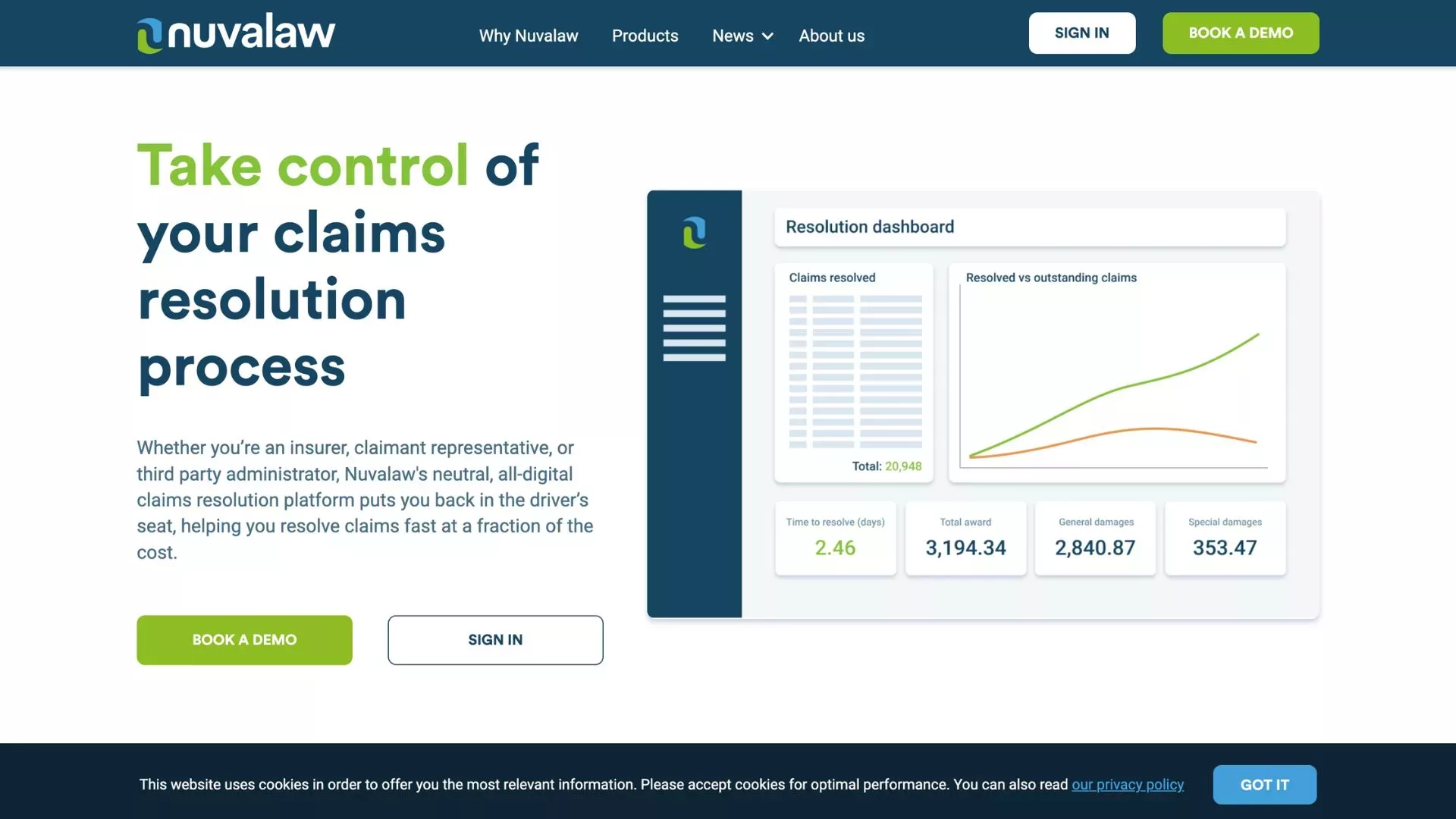

The legal tech landscape is witnessing a tectonic shift, and at the heart of this seismic activity is Nuvalaw, armed with a fresh $3m in its coffers, ready to revolutionize property and casualty (P&C) insurance claims. This isn’t just an evolution; it’s a full-blown renaissance.

The Cash Infusion: A Catalyst for Change

Semantic Capital: Betting Big on Software Sorcery

Semantic Capital, the London-based private investment firm, isn’t just passing the hat around; they’re placing their bets on Nuvalaw’s unique blend of software-driven solutions and intellectual property prowess. This latest funding round is a potent cocktail of equity and debt – a financial elixir set to propel Nuvalaw’s innovative platform to new heights.

The Allies of Innovation

In a joint venture with Trust Arbitration, Nuvalaw has marshaled a commendable clientele, including major insurers and law firms, wielding an arsenal of industry accolades. Their platform isn’t just winning awards; it’s winning hearts and minds, poised to streamline the snail-paced claims resolution process.

The Nuvalaw Revolution: From Concept to Conquest

Conquering the UK Market

Nuvalaw’s existing UK market presence is formidable, but rest isn’t in their dictionary. With AI integration on the horizon, they’re expanding their cloud-based platform to address a broader legal battleground, turning intricate insurance claims from a marathon into a sprint.

The American Ambition

Nuvalaw’s impending foray into the US market is the stuff of legends. The land of opportunity is also the land of litigation extravagance, and Nuvalaw is gearing up to shake the very foundations of claims resolution across the pond.

The Nuvalaw Approach: An Unyielding Quest for Efficiency

Tackling the Waiting Game

The average waiting time for personal injury claims in the UK is a whopping 546 days. Nuvalaw’s platform promises an end to the era of claimant exasperation, insurer financial bleed-out, and liquidity nightmares for lawyers.

The Cost-Cutting Crusade

Nuvalaw isn’t just trimming the fat; they’re on a cost-cutting crusade, wielding their digital efficiency sword to slash related expenses by up to 80%. Their platform is a beacon of hope in the legal tech wilderness, promising to deliver savings on a silver platter.

The Visionaries at Nuvalaw’s Helm

Willie Pienaar: The Chief in Command

Nuvalaw’s CEO, Willie Pienaar, isn’t just steering a ship; he’s commanding a fleet. With Semantic Capital’s backing, he’s setting his sights on international waters, ready to deploy new products and navigate the US market’s turbulent seas.

Craig King: The Financial Maestro

Craig King of Semantic Capital isn’t just signing checks; he’s crafting a legacy. As Nuvalaw continues to disrupt the claims resolution sector, he sees a fertile ground for growth in both the UK and US landscapes, where the cost of loss adjustment and litigation management runs sky-high.

The Future: Nuvalaw’s Legal Tech Utopia

A Revolution Encoded

Nuvalaw’s cloud-based platform is more than a tool; it’s a harbinger of a new era in legal tech. With AI in its arsenal, Nuvalaw is poised to redefine efficiency in the legal sphere, transforming the tedious claims process into a streamlined, cost-effective symphony.

The Litigation Landscape Reimagined

The litigation landscape as we know it is on the brink of transformation. With Nuvalaw’s trailblazing technology, the future looks like a world where lengthy legal procedures are a relic of the past, replaced by swift, AI-driven resolutions.

Your Verdict on the Legal Tech Revolution

The courtroom of innovation is in session, and Nuvalaw is presenting its case. But the jury – you, the esteemed legal professionals – must deliberate. Will you endorse this technological metamorphosis or remain anchored in tradition?

Subscribe to our newsletter for a front-row seat to the unfolding drama. Your voice is crucial, your opinion invaluable. Join the debate, ignite discussions, and be part of the legal tech revolution.

Share this post

Frequently Asked Questions (FAQs)

Q: What is Nuvalaw?

A: Nuvalaw is a legal tech platform specializing in the online negotiation and arbitration of P&C insurance claims, aiming to expedite and economize the claims resolution process.

Q: How much did Nuvalaw raise in funding?

A: Nuvalaw successfully raised $3 million in a pre-series A financing round led by Semantic Capital, combining equity and debt.

Q: What has Nuvalaw achieved with its platform?

A: Nuvalaw has drastically reduced the claims resolution process from over a year to just days, cutting associated costs by approximately 80%.

Q: What will Nuvalaw do with the new funding?

A: The funding will enhance Nuvalaw’s platform, integrate AI technology, and potentially facilitate expansion into the US market.

Q: How does Nuvalaw’s platform improve the claims process?

A: By digitizing and streamlining documentation and communication, Nuvalaw’s platform shortens the lengthy resolution timeline and reduces operational expenses.